Background

Delicious chicken wings and televised sports helped Buffalo Wild Wings avert the financial crisis and oust Hooters as the nation’s top wing chain. While the company claims to appeal to a variety of diners, it’s clear that young to middle aged sports fans fuel its sales growth. Hometown team-themed restaurants generate support for local teams while still presenting a venue for out-of-market fans to catch their favorite team’s game that isn’t locally televised.

Up until now, Buffalo Wild Wings has had few problems competing with local sports bars and wing shops. The company has invested religiously in brand recognition and its objective of “celebrating competition” in its restaurants. Such is the competitive advantage of the 30-year old bar and grill that continues to grow like it just went public. Analysts, however, have begun factoring the growth into estimates, posing lofty expectations for Buffalo Wild Wings in 2012.

Financial Health

On the surface level, Buffalo Wild Wings appears to be in a bit of a liquidity squeeze with a current ratio barely favorable to assets (1.22). Several factors contribute to the abnormally illiquid balance sheet, starting with the recent downturn in chicken wing prices. Wing prices declined by roughly 25% between June 2009 and December 2011, reducing the balance sheet value of the FIFO-priced wing inventory.

Inventory makes up only 1.3% of assets, so wing prices clearly don’t tell the whole story on Buffalo Wild Wings’ poor liquidity. The company’s cash ratio fell 42% to 0.53 in 2011 as marketable securities were liquidized in part to fund three franchise acquisitions. One favorable aspect to the swing in wing prices is its translation into higher cost of sales for Buffalo Wild Wings, yielding lower income taxes and larger operating cash flow.

Sales

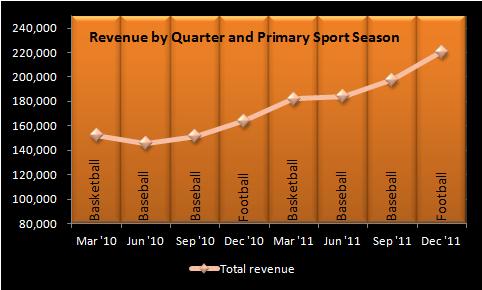

At what point do sports have an adverse effect on Buffalo Wild Wings? The limited quarterly data provided in its annual report suggests some seasonality in revenue. The top line has struggled in the past two second quarters, otherwise known as the first half of baseball season. On the contrary, revenue growth has jumped in the past two fourth quarters, perhaps due to high dining rates during the thick of the football season. What might an NFL lockout have done to Buffalo Wild Wings’ sales?

Chicken wings make up roughly 20% of Buffalo Wild Wings’ cost of sales but the company is slowly diversifying its menu to reduce exposure to highly volatile chicken wing prices. Unfortunately, these moves come in the midst of a downturn in wing prices. However, the move is a smart one – one that has proven successful for industry titans like McDonald’s. Naturally, the strategy will take time to implement, leaving Buffalo Wild Wings a price taker to market wing prices in the interim.

Trends

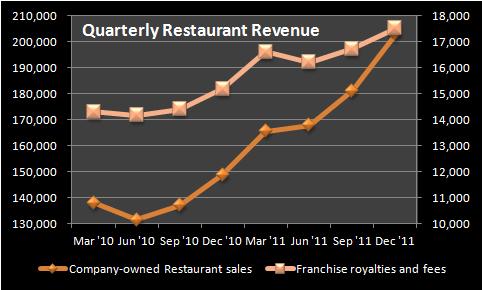

The decision of company-owned versus franchised restaurants is at the helm of Buffalo Wild Wings’ unit expansion plan. While the company claims to be focused on growing both types of restaurants, growth in company-owned restaurant sales has been outpacing franchise royalties over the past two years. Buffalo Wild Wings is planning to open 10 more company-owned restaurants than franchises in 2012, helping to improve the current ratio in favor of franchises. Company-owned restaurants yield significantly more revenue than franchises but require more capital up front.

Buffalo Wild Wings puts a lot of effort into simply getting diners to their locations. Their slogan, “You have to be here”, is included in their most recent TV commercials depicting the restaurants to be a high-energy setting that no one wants to leave. Not surprisingly, take-out made up only 13% of company-owned restaurant revenue in 2011. Restricted assets and system-wide payables – the two accounts relating to advertising and gift card expenses – both grew 30% in 2011, reflecting the growing importance Buffalo Wild Wings places on brand recognition and customer loyalty.

Share Value

Buffalo Wild Wings’ remarkable growth allows the firm to command a higher P/E multiple than the industry average, currently sitting at just over 31. Revenue climbed 11% in the first quarter of 2011, leaving analysts expecting big things for Q1 2012. The consensus EPS estimate of $0.95 per share is a 28% increase from last quarter and reflects heavy optimism for sales during the NFL Playoffs and March Madness.

With a stock price nearing $100 and just off its all-time high, expect Buffalo Wild Wings shares to face some downward pressure. While investors wouldn’t dream of a dividend at this point in time, the lack of one makes the stock an expensive one to own. Buffalo Wild Wings should benefit from the forecasted pickup in the restaurant industry this year but right now faces high expectations for its earnings announcement due on the 24th.

Outlook

Buffalo Wild Wings will want to be creative when the time comes to truly diversify its menu. One revenue driver that isn’t likely to pick up the slack is alcohol. Alcohol accounted for 24% of restaurant sales in 2011 but it came at a price: an asset portfolio weighed down by liquor licenses. Additionally, alcohol poses big risks and lacks capacity for differentiation, despite its luscious margins. Buffalo Wild Wings’ name makes it clear that wings will be what it’s known for a long time – however, a strong complement to hedge variable wing prices wouldn’t hurt.

As this report suggests, Buffalo Wild Wings’ strategy for the future may be more about building its competitive restaurant environment than about its wings. In reality, it will likely be a combination of both. For the near-term, the company seems capable of maintaining its rapid growth in both revenue and EPS. While I believe a pullback in share price to be in the equation this spring, I think Buffalo Wild Wings has substantial opportunity in front of them.

Disclaimer: I do not have a position in Buffalo Wild Wings and do not anticipate having one anytime in the next two weeks. My evaluation of Buffalo Wild Wings does not reflect the opinion of my employer.